- The SaaS Report

- Posts

- The complete breakdown of Figma's S1

The complete breakdown of Figma's S1

here are 11 charts breaking down Figma's S1 - and a prediction on what they're worth today

Background

Figma has filed their S1. The document that companies file with the SEC prior to an IPO. Inside this S1 we get the first public look at their metrics.

Most of you reading this will be familiar with Figma, but a quick recap, they're a design SaaS tool. You could think of Adobe and Canva as their main competitors.

Figma has had an interesting history as a private company.

Founded in 2012 by Thiel fellow Dylan Field and Evan Wallace. It took until 2016 for the product to be released to the general public.

They raised $333M in 5 rounds of funding and in September of 2022 the company announced they had agreed to an acquisition by Adobe for $20B.

This fell through due to concerns the deal wouldn’t be approved on anti—competition lines.

As a result of the acquisition termination, Figma was awarded $1B in cash compensation by Adobe.

That catches us up and somewhat overlays the information in the S1.

Now as a part of this S1 Figma has released the last 9 quarters of income statements. So we can get a pretty good understanding of some of the key SaaS metrics over that time.

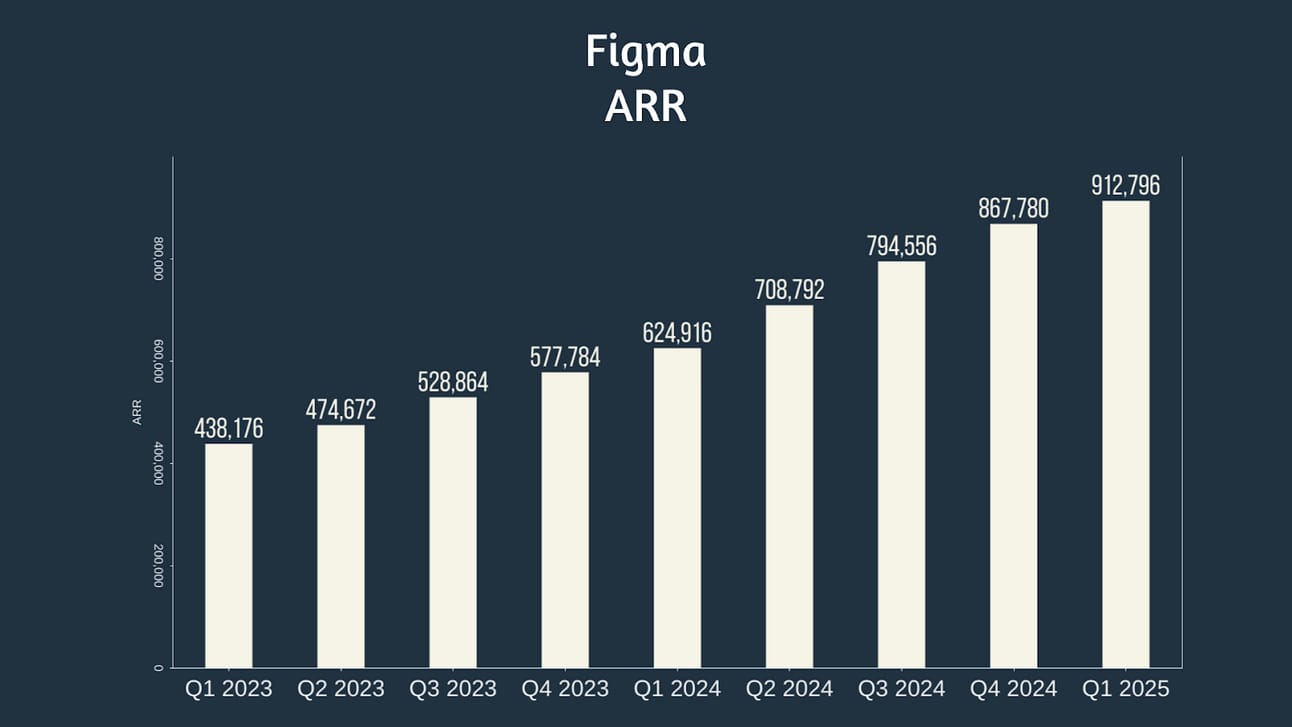

Let’s look first at ARR.

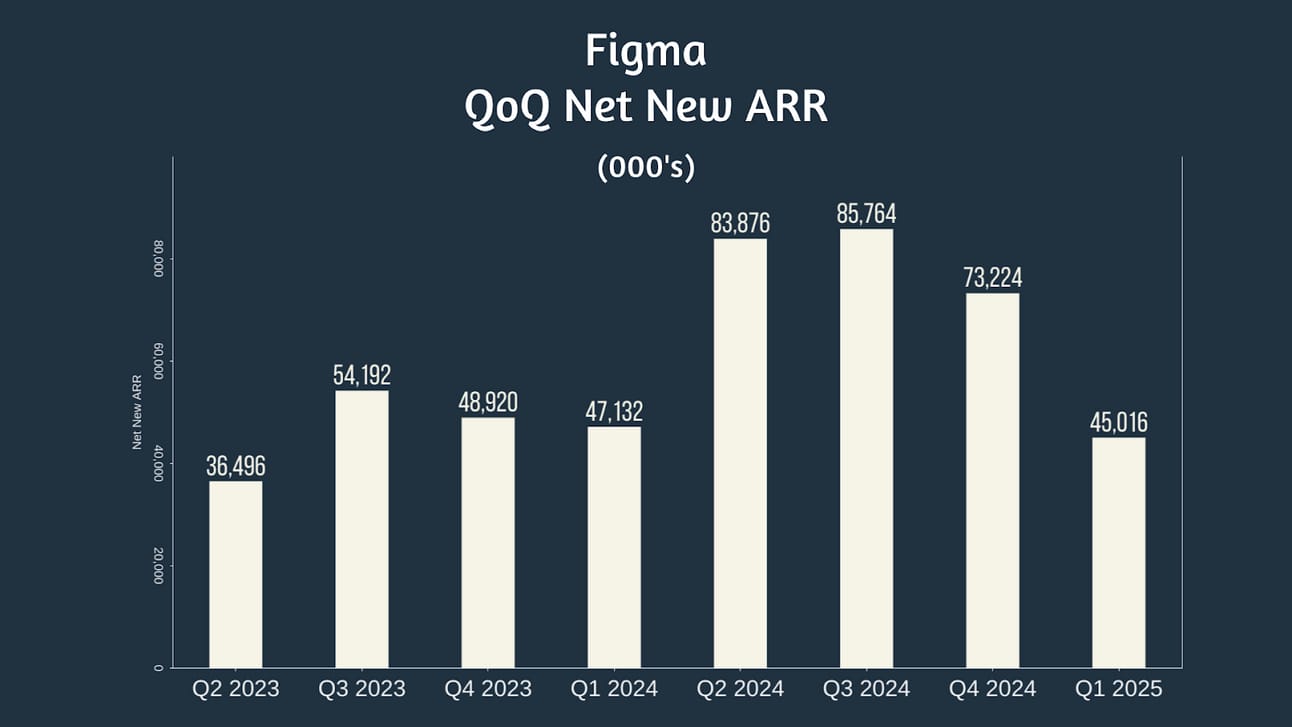

Note: Q2 of 2024 is an outlier. In this quarter Figma deployed a lot of cash after being awarded a $1B acquisition termination fee from Adobe. |

ARR Run Rate

QOQ Net New ARR

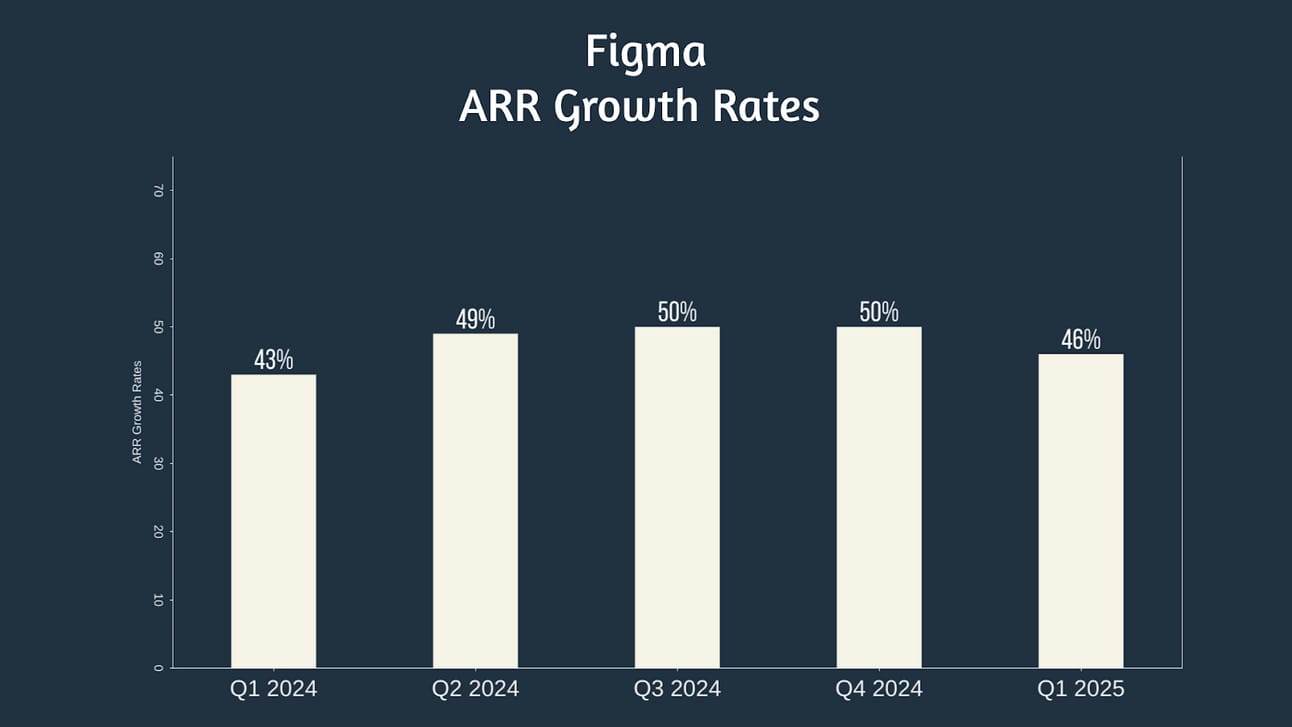

Year Over Year ARR Growth Rates

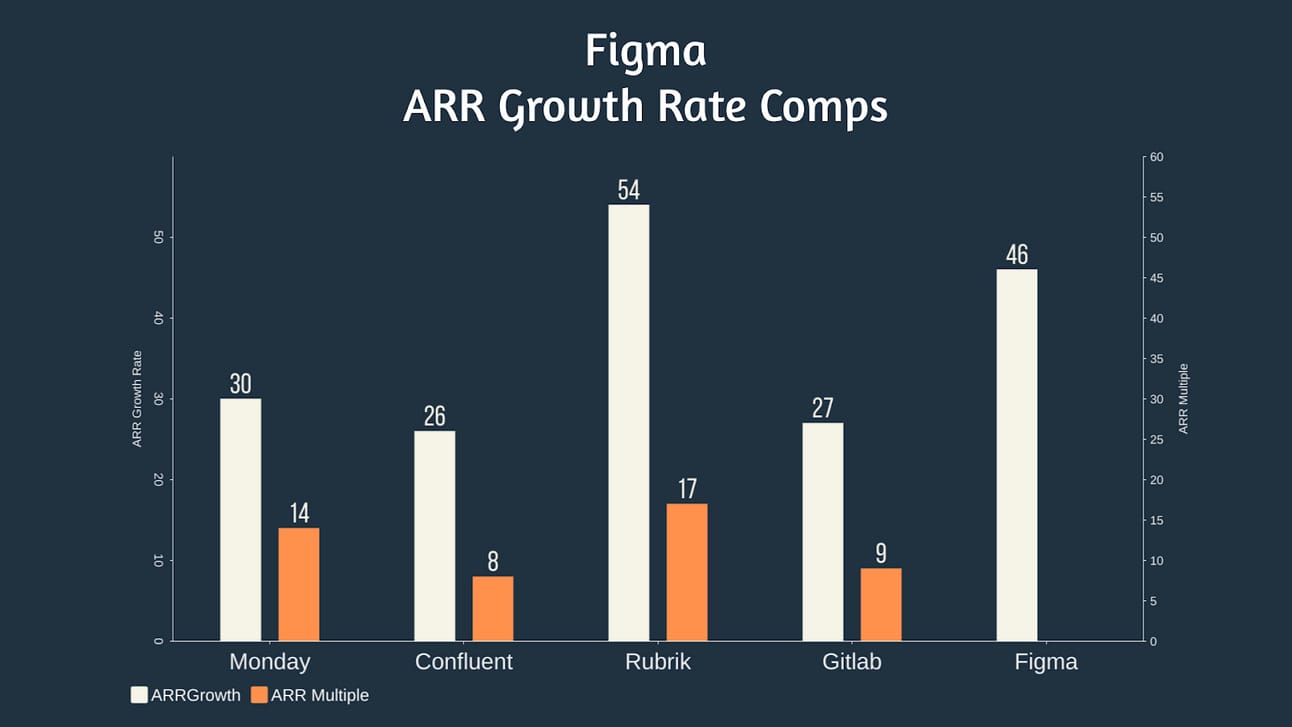

In Q1 of 2025 the median ARR growth rate across the companies we tracked was 18%. As we can see in the chart above Figma generated 46% ARR growth. Only Rubrik and AppLovin had growth rates higher than Figma’s in Q1

They’re growing faster than Palantir, Klaviyo and Monday. Exceptional performance.

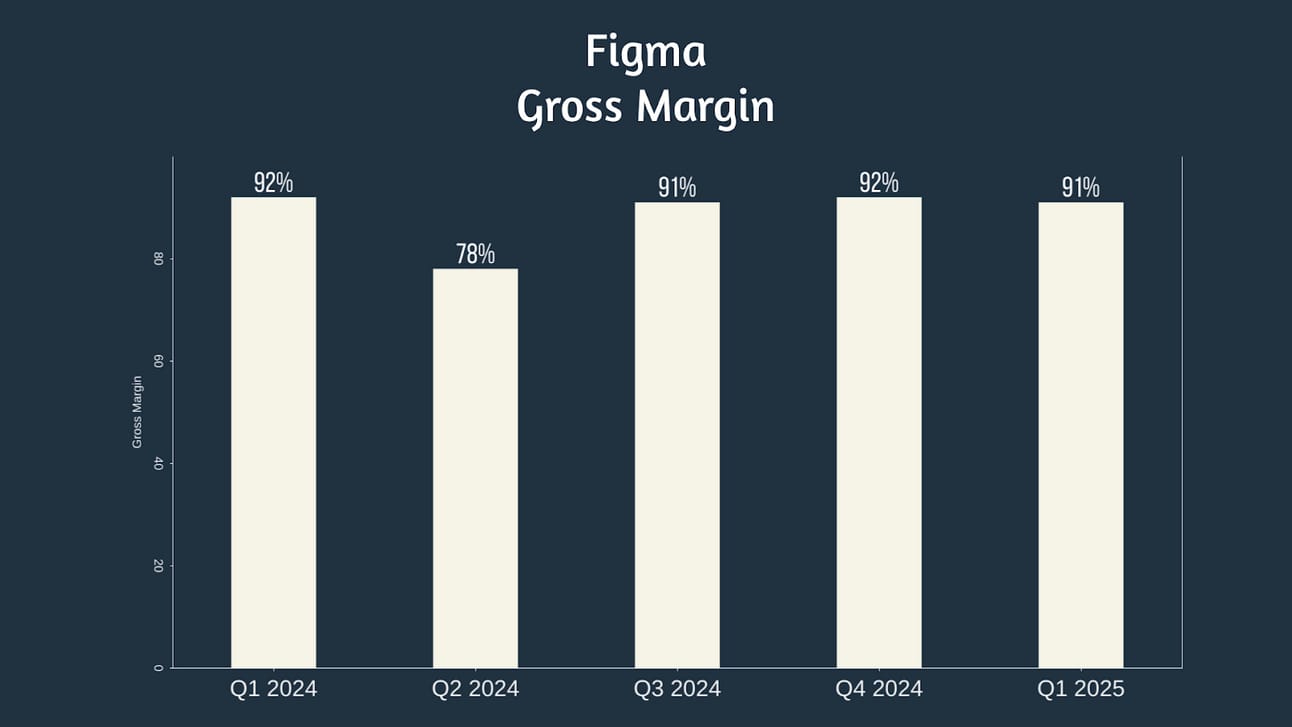

Gross Margin %

90% + gross margins are truly best in class. Monday and Asana had GM% of 90% – so Figma would have the best GM of any of the companies we track. Median across all of the companies we track is 78%

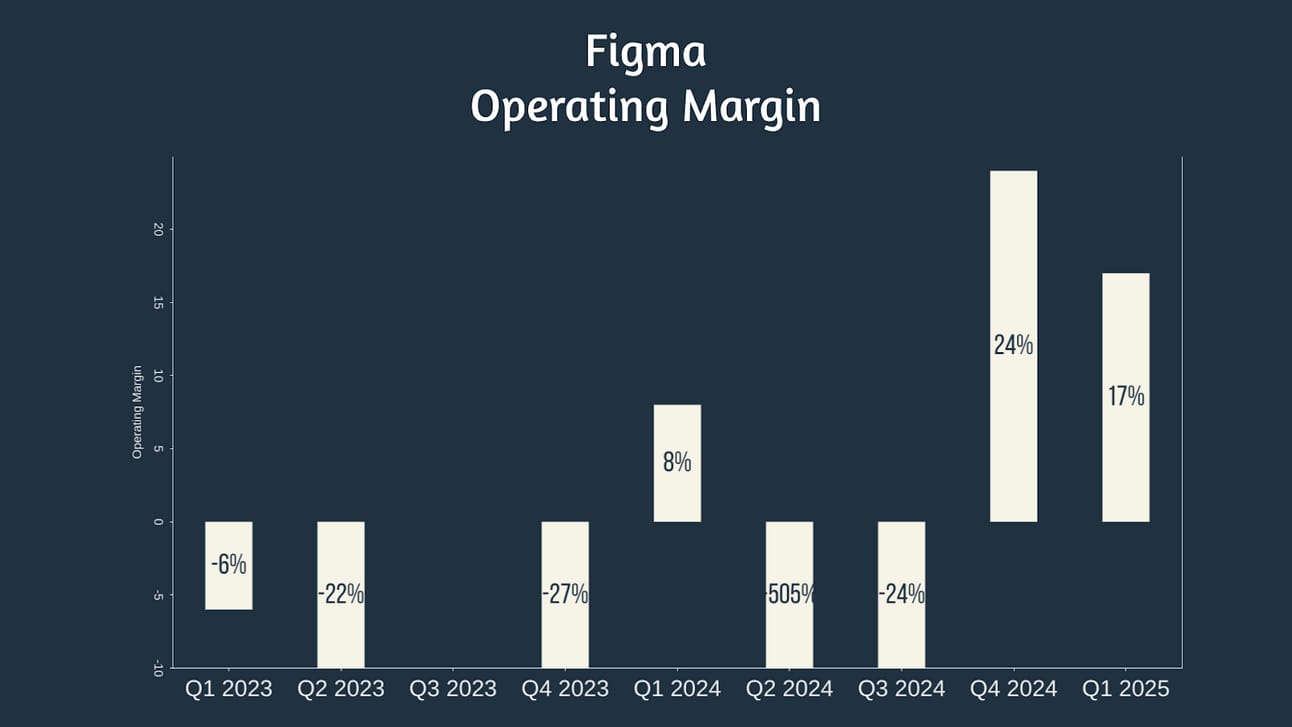

Operating Income

This is all over the place. This is something that will have to become more predictable and consistent as a public company. You just don’t see swings like this for public SaaS co’s.

Hard to get a read here on where this will settle at but if we take the midpoint of the last 2 Quarters that would put them at about a 20% Operating margin. It’s unlikely it stays this high as they’ll be pushed to deploy spend into R&D an S&M to ensure growth rates continue. But a promising sign they’re able to generate this level of efficiency when required.

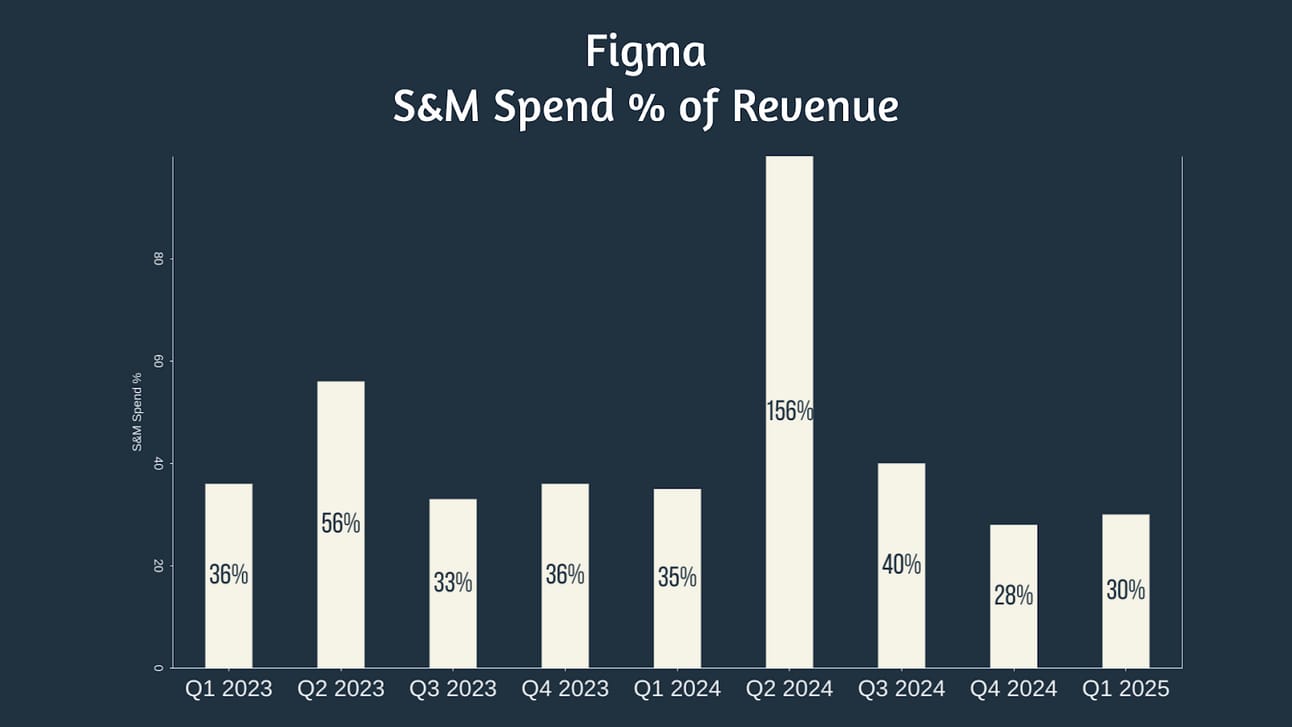

S&M Spend

This metric is again all over the place. Looks like they might be trying to settle around the 30% range. That’s comparable with companies like Datadog 28%, Pegasystems 29%, Appian 30%, but is on the low end. The median across the companies we track is 40%. Only about 25% of the companies we track have S&M send of 30% or less.

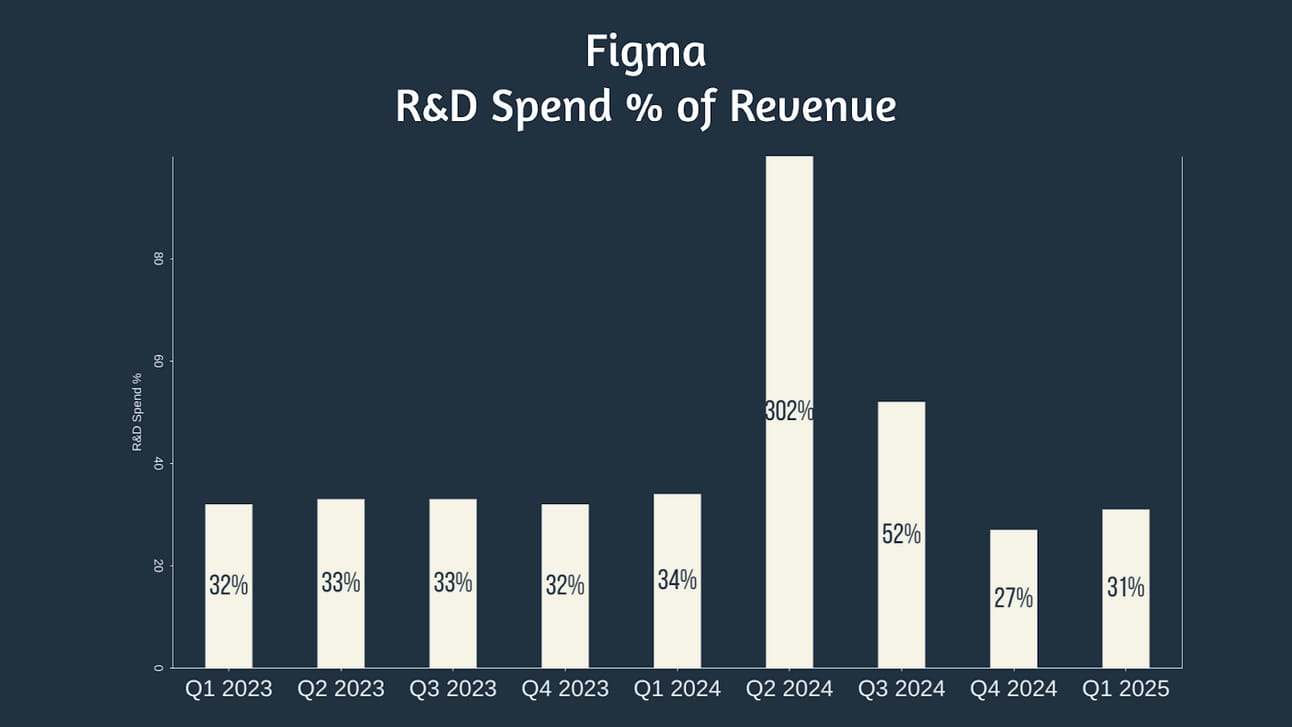

R&D Spend

Looks like this is likely to settle in the low 30’s. In the range of companies like Hubspot, MongoDB, Gitlab, Crowdstrike and Sentinelone. That’s slightly on the high side. Median is 26% – but much more in line with the market compared to S&M spend.

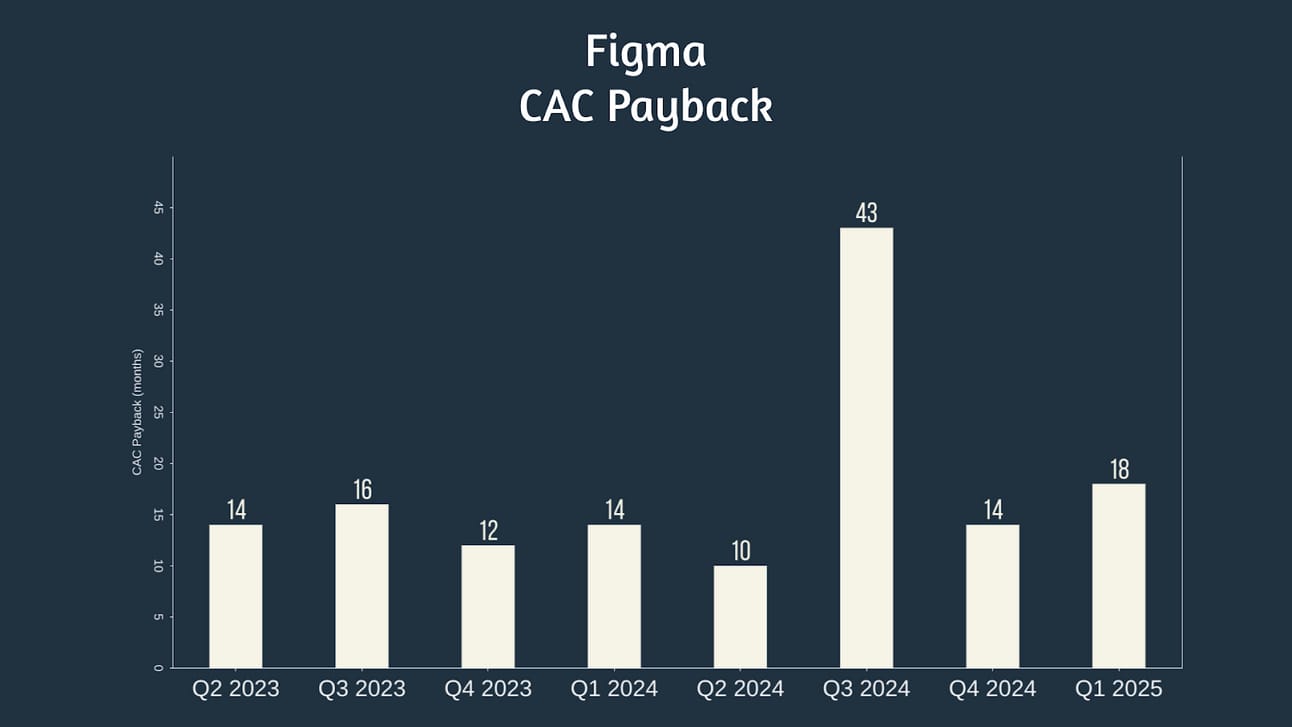

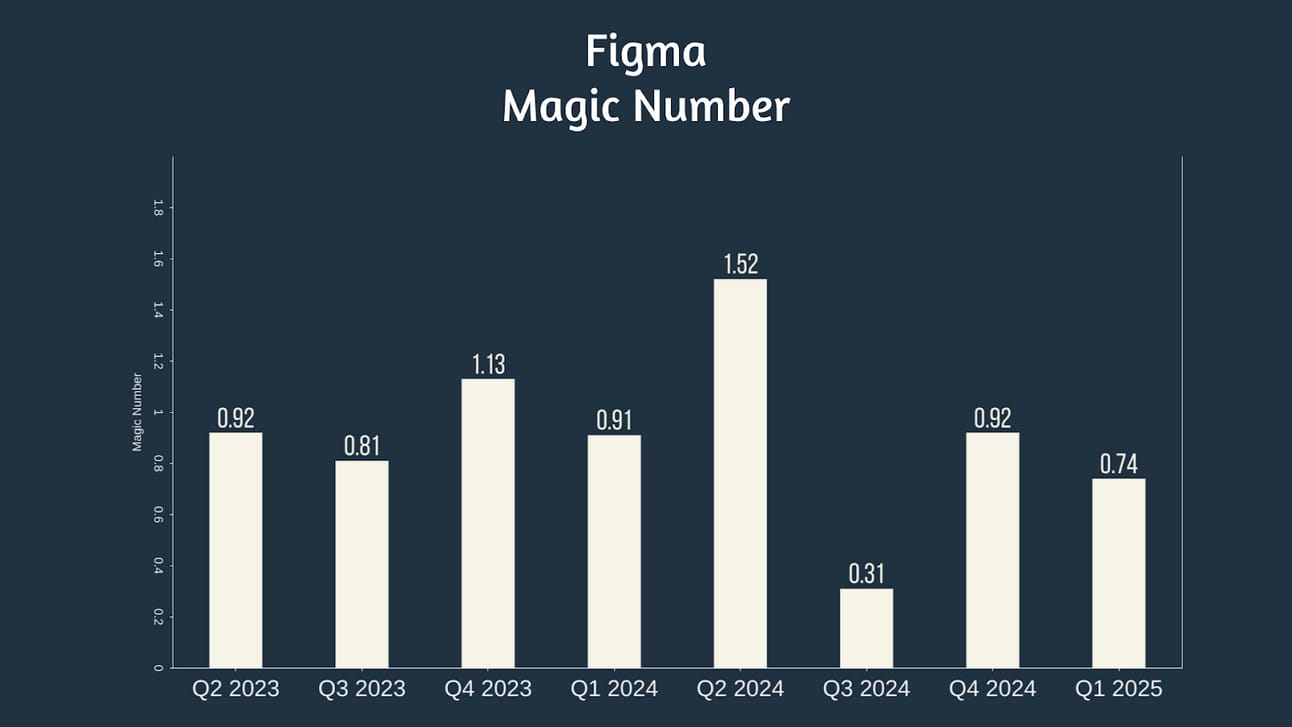

CAC Payback

Averaged 20 month CAC payback from $475M to $912M in ARR

The Median of 14 months over the last 8 quarters is again best in class.

The 14 month figure puts Figma in the same ball park as the most efficient pure play SaaS co’s Palantir, Veeva and Atlassian.

Q1 Magic number figure of 0.74 would put them in 7th place on our list. Only AppLovin, Palantir, PegaSystems, Veeva Atlassian and Datadog turned S&M spend in Net New ARR more efficiently.

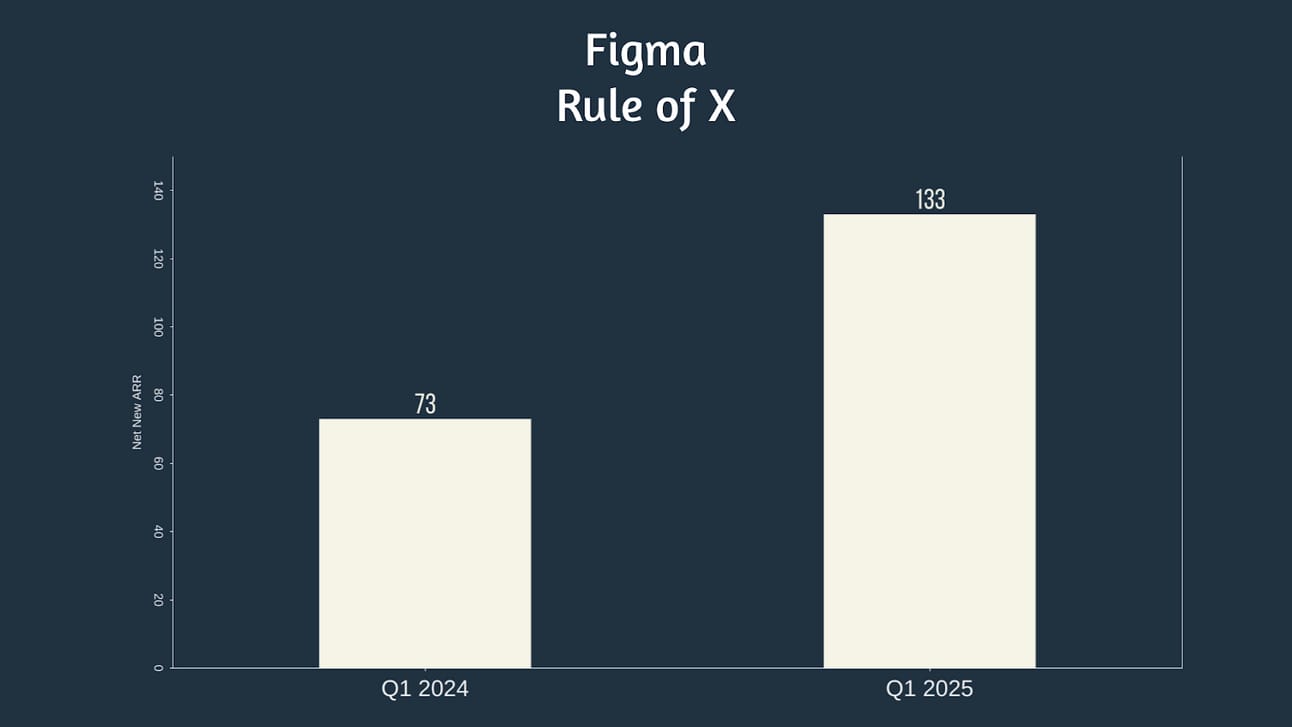

Rule of X

Bessemer Venture Partners have shown us that Rule of X is the best predictor of valuation. 133 in Q1 gets them in 4th place on our list behind AppLovin, Veeva and PegaSystems.

So what will Figma be worth as a public company?

What do we have with Figma?

PLG SaaS Co - high growth – Around $1B in ARR but no a super clear picture in terms of FCF margin.

Last 12 month number was (70M) and Q1 of this year was $94M (likely juiced for this report) or is a seasonal bump in Q1 not unlike what we see for companies like Veeva and Salesforce.

So the public co’s that we have in this $1B – high growth range are: Monday, Confluent, Rubrik, Gitlab.

Now as at Q2 Figma will be close to $1B in ARR. I think Monday is a pretty good comp for them.

Lets assume a small multiple reduction just based on the added risk they haven’t operated as a public company before and I think Figma probably ends up trading at around 12X ARR. Giving them about a $12B valuation right now.

Still no definitive timeframe on when they go public but we’ll keep an eye on this for sure over the next few months.