- The SaaS Report

- Posts

- Adobe Q2 | 11% ARR Growth | 31 Month CAC Payback

Adobe Q2 | 11% ARR Growth | 31 Month CAC Payback

Good quarter from Adobe in Q2. Are they cheap at 7x ARR?

We got Q2 Numbers from Adobe last week. And they’re really impressive.

They’re not in the basket of companies that we track, but I’ll add them to it for Q2.

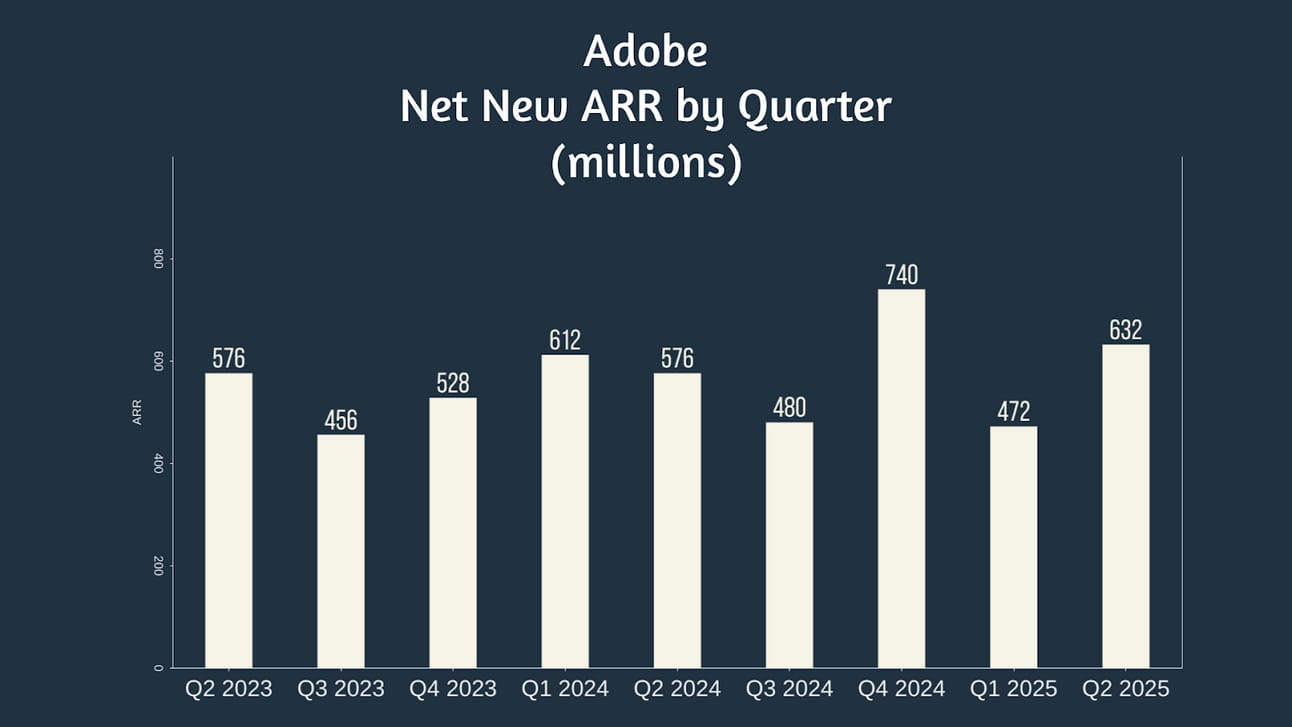

So Adobe is doing $22.5B in ARR

ARR grew by 11% YoY

They added $2.3B in net new ARR over the last 12 months

And $632M in Q2.

They’ve got exceptional Gross margins. They came in at just under 93% which is insane.

Median for the companies we track is 78%.

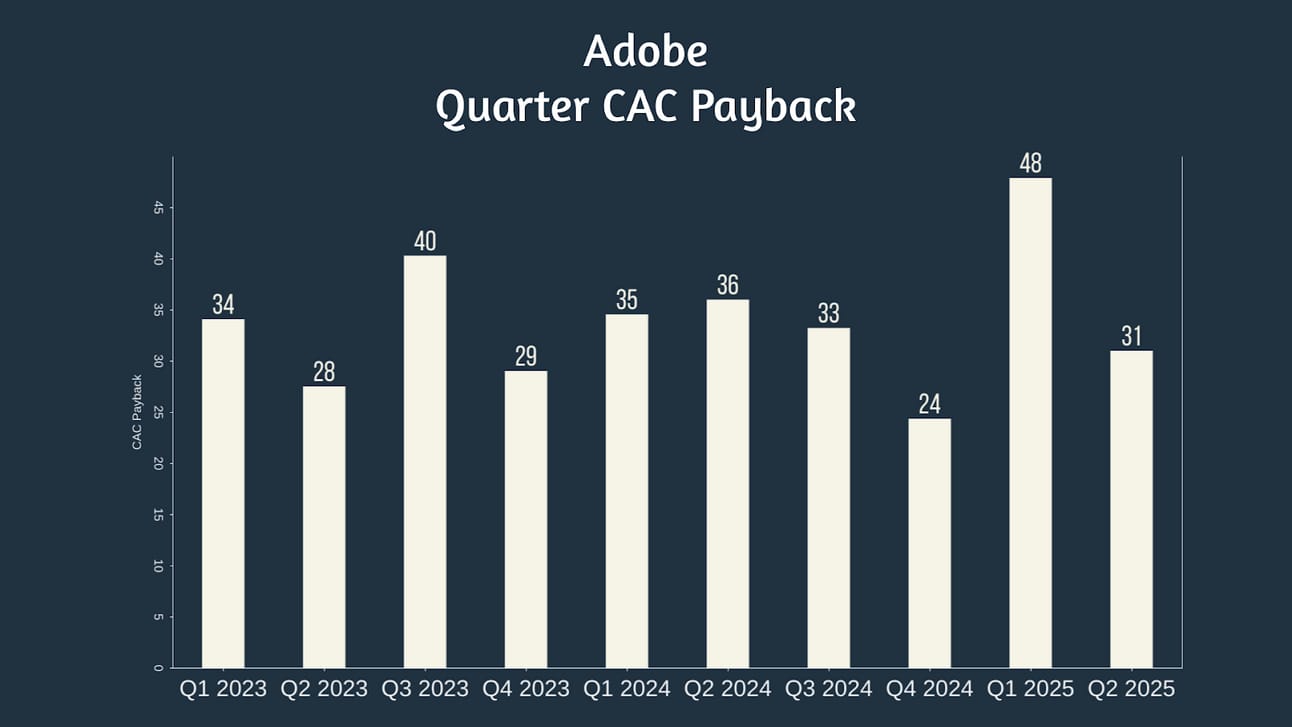

They spend about 18% of rev on R&D

28% on S&M.

So total S&M spending in Q2 was $1.6B

CAC payback for Q2 was 31 months. Pretty good for a company at their scale and well below the 38 month median of the companies we track.

Other metrics of note:

37% FCF margins

36% operating margins (crazy high)

$708K in ARR per employee. (amazing)

And RPO of just under $20B

Good Quarter for Adobe.

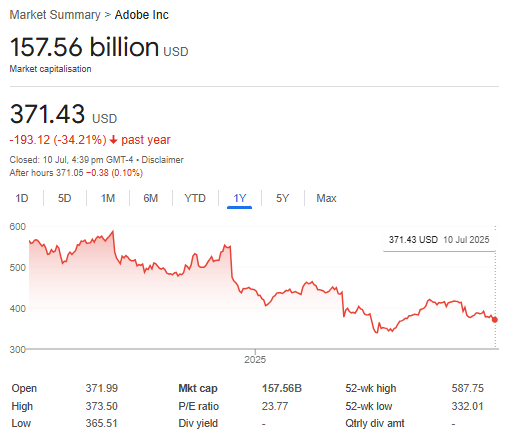

They’re trading at a $160B market cap or about 7X ARR.

Looks cheap??